by Geoff | Mar 7, 2018 | Getting a Mortgage, Mortgage Broker, Rates

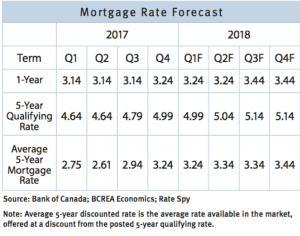

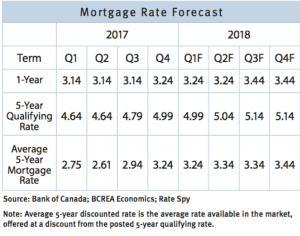

2017 was a year of change for the Canadian Mortgage Market. With the announcement of the B-20 guideline changes requiring all insured or uninsured mortgages to undergo stress testing. In addition, the removal of mortgage bundling and the continued rate rises from the...

by Geoff | Jan 18, 2018 | Getting a Mortgage, Market Updates, mortgage trends, Rates

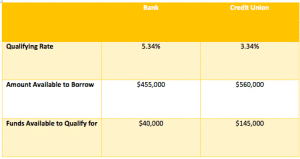

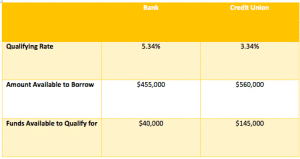

Banks and Credit unions are often grouped together into one category under “financial institutions”. While they may have several similarities in terms of financial service offerings, in the world of mortgages the banks and credit unions have little in...

by Geoff | Dec 21, 2017 | Getting a Mortgage

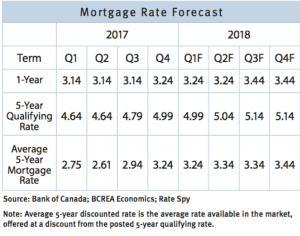

There is a lot that can change in the real estate market and the economy from year to year. As a homeowner with a mortgage, it is important to make sure that you are getting the most savings possible. A mortgage review can help you out with this. What does a mortgage...

by Geoff | Dec 1, 2017 | Getting a Mortgage, Market Updates, mortgage trends, Refinancing

As many of you may remember, this past October the Office of the Superintendent of Financial Institutions (OSFI) issued a revision to Guideline B-20 . The changes will go into effect on January 1, 2018 but lenders are expecting to roll this rules out to their...

by Geoff | Nov 17, 2017 | Getting a Mortgage

Paperwork-it’s a fact of life. You need it and we as mortgage professionals also need it. Below is a list of must have documentation BEFORE you start going through the mortgage approval process. Personal Information This will be the basic information we require...

by Geoff | Nov 9, 2017 | Getting a Mortgage, Mortgage Insurance

When you purchase a property, you may be a little overwhelmed by all the insurance offers related to the purchase of said property. Mortgage Insurance, Condo Insurance, Mortgage Default Insurance, Earthquake Insurance; the list goes on and on. It can be confusing, and...

Recent Comments