by Geoff | Nov 4, 2016 | DLC, Finances, First Time Home Buyers, Getting a Mortgage, mortgage trends, Rates, Refinancing

What is the maximum mortgage amount one now qualifies for with the rules that came into effect on October 17th? Short answer: LESS. A minimum of 20% less, in fact. Before October 17th, the lenders calculated the maximum mortgage amount based on the contract rate of...

by Geoff | Oct 24, 2016 | Finances, First Time Home Buyers, Getting a Mortgage, Mortgage Broker, Rates

Most of us know that changing your mortgage payment from monthly, or semi monthly, to an accelerated bi-weekly payment instantly reduces your standard 25 year amortization by 2.58 years with today’s rates. (If you didn’t know that, you’re likely not working with the...

by Geoff | Oct 21, 2016 | Credit Score, Finances, First Time Home Buyers, Getting a Mortgage, Rates

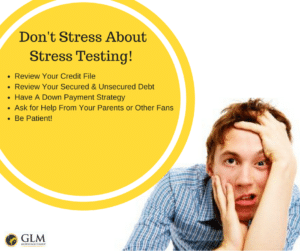

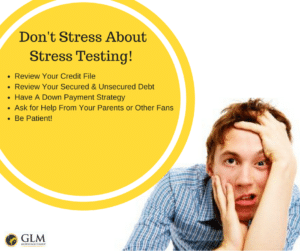

That’s right! Sure the new mortgage rules from our Federal Government on October 17th can be a bit confusing, here are five tips to help you with your mortgage while at the same time, reducing your stress. 1. Review your Credit File: Good credit is your ticket to...

by Geoff | Oct 18, 2016 | Credit Score, Finances, First Time Home Buyers, Getting a Mortgage

If you have have overextended yourself with credit card debt, or have consolidated all of your consumer debt into your mortgage, or are at the point where you just want to cancel your credit cards, we have the 3 steps for you to follow to get your credit back in...

by Geoff | Oct 12, 2016 | DLC, Finances, First Time Home Buyers, Getting a Mortgage, GLMG Services, mortgage trends, Rates

By now you will have likely heard that the Federal Finance Minister has made drastic changes to mortgage lending rules making it tougher to qualify for a mortgage. For Canadians with less than a 20% down payment, their purchasing power has been dramatically reduced....

by Geoff | Oct 11, 2016 | First Time Home Buyers, Getting a Mortgage, House Hunting

Often times it’s the simple math that will betray you when selling a property. In your head you do quick calculations, you take what you think your property will sell for and then subtract what you owe on your mortgage, and the rest is your profit! Well… not so fast,...

Recent Comments