How to use an Affordability Calculator

Why This Blog is Important to You: The affordability calculator allows you to input your financial information and accurately estimate the maximum home price you can afford. This helps you gain a clear understanding of your financial capabilities and sets realistic expectations for your home-buying journey.

Introduction

Last week we talked about an affordability calculator and why it is important. Today, we are going to talk about how to use and read it. We are going to base it on the Canada Mortgage and Housing Corporations tool that they have as an Affordability Calculator.

Here is the first page you will find when you click into the site for the Affordability Calculator tool made by the Canada Mortgage and Housing Corporation.

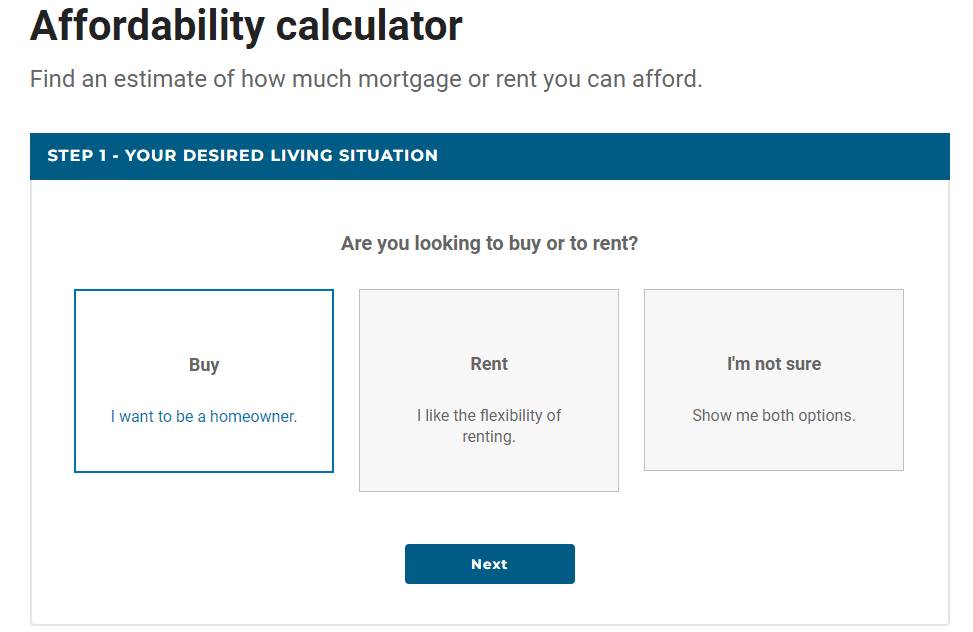

As a mortgage group, we will be focusing on the section that looks at if you are wanting to buy.

How To Use an Affordability Calculator Part 1

When you enter the app you will want to click the Buy (I want to be a homeowner). Once you have done that you can click Next.

How To Use an Affordability Calculator Part 2

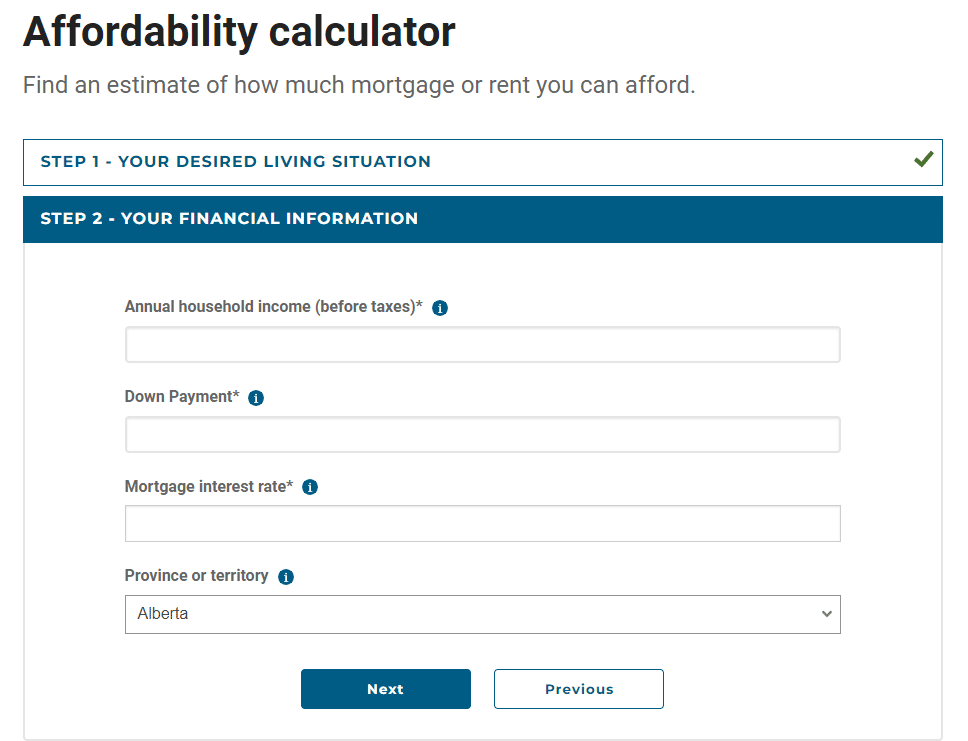

Next you will want to fill out this page pictured below. You will want to be as honest as you can based on the factors that are within your control.

How To Use an Affordability Calculator Part 3

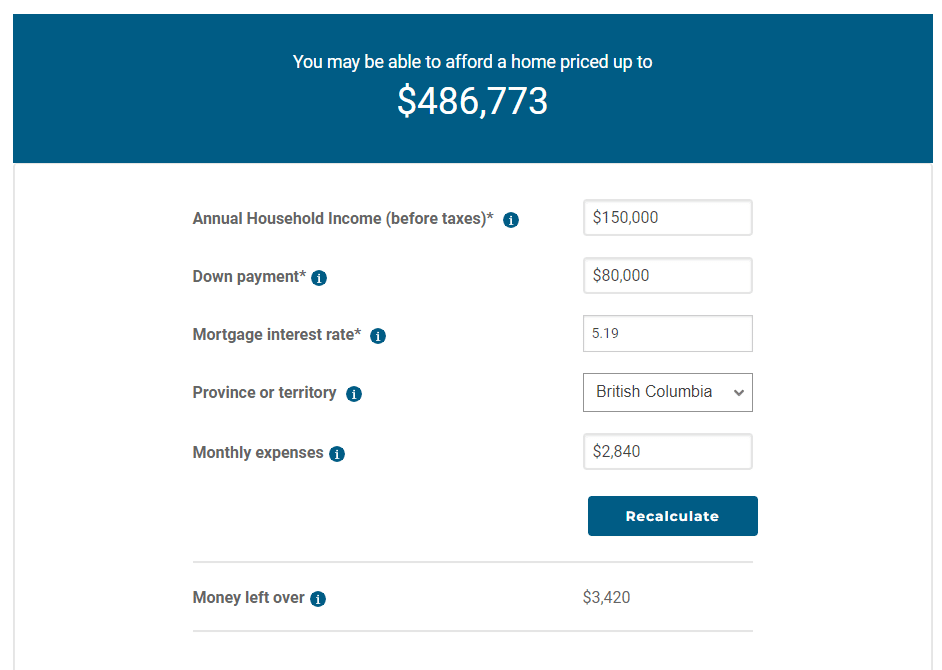

As pictured below, we will be considering a household income of $150,000 (based on two $75,000 salaries). We will assume for the sake of this blog that the buyer wants to put at least 20% down on a place of $400,000 or higher. We will input the 20% on $400,000, which is $80,000.

We will then use our current rate on a 5 year term, which is 5.19% and put BC as the province we are living in as that is where we are based.

How To Use an Affordability Calculator Part 4

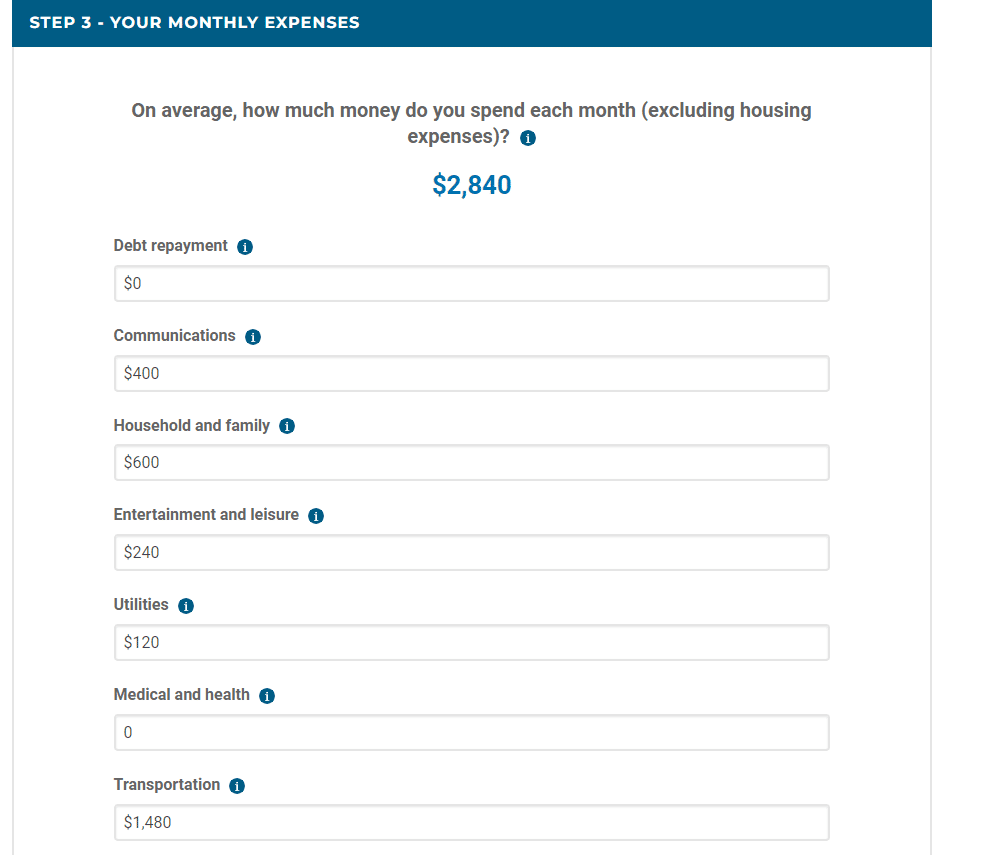

Pictured below we have your monthly expenses. We are going to work Canadian averages to calculate normal expenses.

On average the Canada will spend in a month $300 on groceries and an average of $740 in car fees (monthly loan, insurance cost, gas and car maintenance fees). The average Canadian also spends about $200 on communication devices (phones), $120 on recreational activities, and about $60 a person on utilities.

We doubled each average amount to account for a household of 2 people. We did not include potential debts an individual may have (credit card debt, student debt, etc.) and we did not include additional medical fees.

How To Use an Affordability Calculator Part 5

Pictured below is the calculation created based on the variables that make up the financial situation we used for this scenario.

Here it shows that you could likely afford a home up to $486,773. It shows you the money you likely have left over per month which can go towards your mortgage payment.

Obviously an affordability calculator is a baseline and does not account for potential of salary increases in the future, financial burdens that arise from emergencies, unforeseen events, having children and/or other monthly expenditure needs.

Conclusion

In conclusion, the affordability calculator provided by the Canada Mortgage and Housing Corporation is a valuable tool for individuals looking to determine their purchasing power in the housing market. By inputting relevant financial information, such as income, expenses, and desired down payment, the calculator generates an estimate of the maximum home price that can be afforded.

However, it is important to remember that the affordability calculator is just a starting point and should not be considered as the final word on affordability. It does not take into account factors such as potential salary increases, unexpected financial burdens, future life changes, and additional debt obligations. These factors can significantly impact one’s financial situation and should be carefully considered when making housing decisions.

Therefore, while the affordability calculator provides a helpful guideline, it is crucial to conduct a comprehensive financial assessment and seek professional advice to ensure a sound and sustainable home purchase. Consulting with a mortgage specialist or financial advisor can provide personalized insights and guidance based on individual circumstances. For this reason, we would love to set up a time to meet with you.

Give us a call from the number on this website and we guarantee that we will either answer your call promptly or get back to you within 90 minutes. We understand the importance of timely communication and want to ensure that your questions, concerns, and inquiries are addressed promptly. Our dedicated team is eager to assist you and provide the support you need throughout the home-buying process.