Empowering Homebuyers: The Importance of an Affordability Calculator for Mortgages Introduction In the ever-evolving Canadian real estate market, buying a home is a dream for many. Whether you’re stepping onto the property ladder for the first time or upgrading to a...

Geoff

Empowering Homebuyers: The Importance of an Affordability Calculator for Mortgages

Empowering Homebuyers: The Importance of an Affordability Calculator for Mortgages Introduction In the ever-evolving Canadian real estate market, buying a home is a dream for many. Whether you’re stepping onto the property ladder for the first time or upgrading to a...

Second Mortgages vs. Refinancing in Vancouver, BC

Streamline Your Financial Journey: Second Mortgages vs. Refinancing in Vancouver, BC For homeowners in Vancouver, BC, tapping into the equity built within your home can be a strategic way to meet financial goals, manage debt, or fund major projects. The big question...

Understanding Closing Costs: Budgeting Beyond the Purchase Price

Understanding Closing Costs: Budgeting Beyond the Purchase Price When purchasing a home, the sticker price is just the beginning. While the purchase price is the most significant financial commitment, many homebuyers in British Columbia and across Canada often...

Programs for First-Time Home Buyers: What You Need to Know

Programs for First-Time Home Buyers: What You Need to Know t-TiFortunately, there are various programs and incentives available to first-time home buyers in Canada, designed to make homeownership more accessible and affordable. This blog will delve into these...

Choosing the Right Neighborhood: Factors to Consider

Choosing the Right Neighborhood: Factors to Consider When Buying a Home Choosing the right neighborhood is one of the most important decisions you'll make when buying a home. Choosing the right neighborhood can enhance your quality of life, influence your home's...

CMHC vs. Private Insurance

Understanding Mortgage Default Insurance: CMHC vs. Private Insurance When embarking on the journey of homeownership across Canada, one term that often surfaces is "mortgage default insurance." This crucial element of the home buying process is designed to protect...

Tax Implications of Owning Rental Property in Canada

Tax Implications of Owning Rental Property in Canada Owning rental property in Canada can be a lucrative investment, offering both steady income and potential for property appreciation. However, it also comes with significant tax implications that landlords must...

Renting vs. Buying: Financial Considerations for Canadians

Renting vs. Buying: Financial Considerations for Canadians The age-old question of renting vs. buying a home is one that many Canadians grapple with on a daily basis. The decision is not only about having a place to call your own but also involves significant...

How to Pay Off Your Mortgage Early: Strategies That Work

How to Pay Off Your Mortgage Early: Strategies That Work Owning a home is a dream many of us hold dear, and securing a mortgage often becomes a necessary step toward realizing that dream. However, the long-term commitment of a mortgage can feel overwhelming. The good...

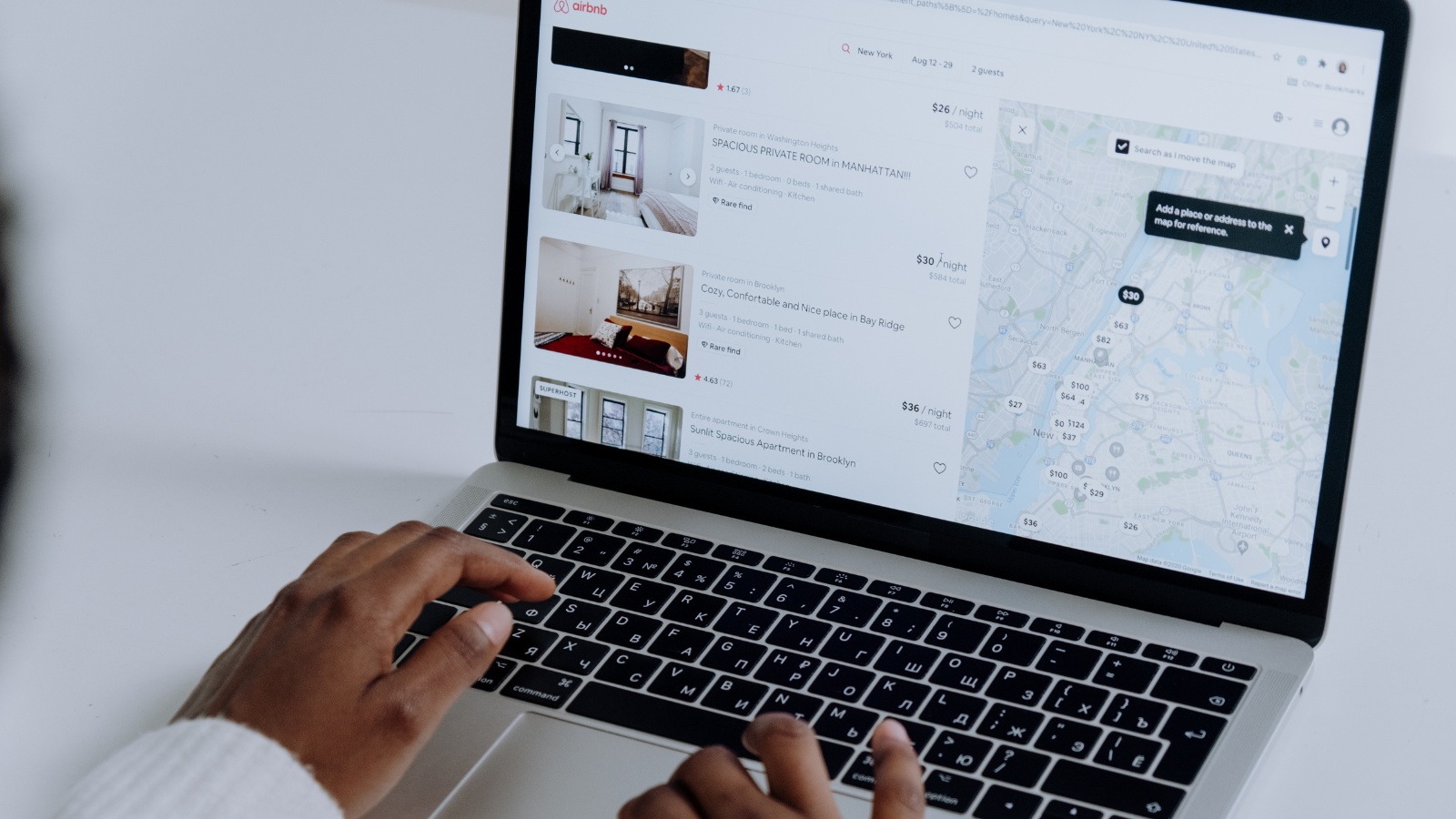

New Short-Term Rental Regulations in Effect May 1, 2024: What You Need to Know

New Short-Term Rental Regulations in Effect May 1, 2024: What You Need to Know As of May 1, 2024, significant changes to short-term rental regulations have taken effect in British Columbia (B.C.). These new rules, aimed at addressing the housing crisis by returning...

Navigating Financial Strain in 2024: How We Can Help

Navigating Financial Strain in 2024: How GLM Mortgage Group Can Help The financial strain on Canadian households escalated in the first quarter of 2024, with missed payments on mortgages and other credit returning to pre-COVID levels, according to a report by Equifax...