by Geoff | Jan 16, 2020 | mortgage trends

Happy New Year Everyone! We are excited for what this year holds and for everything that we have seen happening in the mortgage industry the past few months. One new thing we are introducing is our “Fast Five” Series. This will include 5 key things you...

by Geoff | Apr 5, 2019 | Mortgage Broker, mortgage trends

One of the top questions we get asked: Should I pay down my mortgage as fast as possible? In theory, this makes sense. The faster you pay it down, the faster you get out of debt, right? For many people that is the case and it does make sense often times to take this...

by Geoff | Jan 11, 2019 | Bank of Canada, Getting a Mortgage, mortgage trends

2018 Is in the Books, Here are the Q4 numbers! 2018 was a challenging year for the housing and mortgage market—new regulations, rate increases and more made it one of the toughest years for homeowners to qualify. Despite all this, there was still $45.3 billion...

by Geoff | Mar 19, 2018 | Market Updates, Mortgage Broker, mortgage trends

The mortgage industry seems to be ever-changing. What was applicable one day seems to no longer apply to the next and at times, it can be confusing to navigate through what all of these changes mean–and how they impact you directly. As Mortgage Brokers, we...

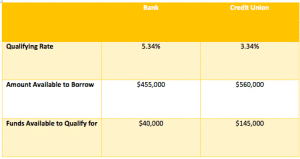

by Geoff | Jan 18, 2018 | Getting a Mortgage, Market Updates, mortgage trends, Rates

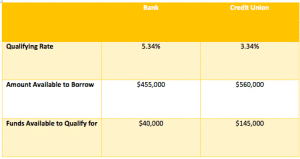

Banks and Credit unions are often grouped together into one category under “financial institutions”. While they may have several similarities in terms of financial service offerings, in the world of mortgages the banks and credit unions have little in...

by Geoff | Dec 1, 2017 | Getting a Mortgage, Market Updates, mortgage trends, Refinancing

As many of you may remember, this past October the Office of the Superintendent of Financial Institutions (OSFI) issued a revision to Guideline B-20 . The changes will go into effect on January 1, 2018 but lenders are expecting to roll this rules out to their...

Recent Comments