Do you have a mortgage? So, do I! Looks like we have something in common :). Did you know that 6 out of 10 consumers break their mortgage 38 months into a 5-year term? That means that 60% of consumers break a 5-year term mortgage well before it’s due…but do you also...

Geoff

Top 5 Things To Consider When Building Your New Home

Building a new home-It’s something that many couples dream of. It can be an exciting, stressful, joyful, crazy time period that many walk away from saying “never again” or “bring on the next one!” We scoured the internet and sorted through our own experiences to bring...

Changes in the Mortgage Industry | From stress testing and the BC Budget, to Rate Increases and More

The mortgage industry seems to be ever-changing. What was applicable one day seems to no longer apply to the next and at times, it can be confusing to navigate through what all of these changes mean--and how they impact you directly. As Mortgage Brokers, we firmly do...

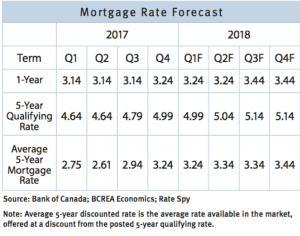

Where are Canadian Mortgage Rates Going in 2018?

2017 was a year of change for the Canadian Mortgage Market. With the announcement of the B-20 guideline changes requiring all insured or uninsured mortgages to undergo stress testing. In addition, the removal of mortgage bundling and the continued rate rises from the...

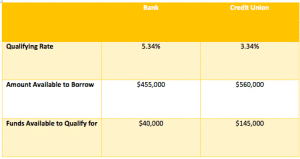

Bank vs. Credit Union-A who is who in borrowing

Banks and Credit unions are often grouped together into one category under "financial institutions". While they may have several similarities in terms of financial service offerings, in the world of mortgages the banks and credit unions have little in common. As...

Bank Broker vs. Mortgage Brokers | Here’s the Scoop

Ask any mortgage broker and they can tell you that there are a handful of misconceptions that the public has about working with a mortgage broker. From questioning their credentials (we all are regulated and licensed within our own province, and are constantly...

What is an Annual Mortgage Review?

There is a lot that can change in the real estate market and the economy from year to year. As a homeowner with a mortgage, it is important to make sure that you are getting the most savings possible. A mortgage review can help you out with this. What does a mortgage...

How to Repair Credit

Credit history has become one of the most important factors banks consider when deciding whether or not they want to lend you money. Your credit history can determine your ability to buy a car, rent an apartment, or even to purchase your first home. Everything you do,...

UPDATED: OSFI MORTGAGE CHANGES

As many of you may remember, this past October the Office of the Superintendent of Financial Institutions (OSFI) issued a revision to Guideline B-20 . The changes will go into effect on January 1, 2018 but lenders are expecting to roll this rules out to their...

Mortgages and Paperwork

Paperwork-it’s a fact of life. You need it and we as mortgage professionals also need it. Below is a list of must have documentation BEFORE you start going through the mortgage approval process. Personal Information This will be the basic information we require...

Mortgage Insurance 101

When you purchase a property, you may be a little overwhelmed by all the insurance offers related to the purchase of said property. Mortgage Insurance, Condo Insurance, Mortgage Default Insurance, Earthquake Insurance; the list goes on and on. It can be confusing, and...

GLM CONTEST | Enter to Win!

Leave a Review, that's all you have to do! Christmas has come early here at GLM! If you have worked with us in the past, learned something from GLM, or are a GLM fan we want to give you the chance to win DINNER AND A MOVIE ON US! To enter we made it as...