Blog

Our Latest Posts

The latest thoughts and insights from Geoff Lee and GLM Mortgage Group | Dominion Lending Centres

Mortgages Rates are rising but you don’t need to be Alarmed

Yes, rates are rising. However, STOP! Don't to be alarmed! Consider this, rates just 5 years ago were above 5% . We are STILL below that! We need to stop raising the red flags of despair and the concerns about these high rates. In reality these are still great rates....

Vancouver real estate numbers can deceive, says expert

According to Jeremy Nuttall of 24 hours Vancouver: Vancouver real estate numbers can deceive "Real estate sales in Vancouver are reported to be on the upswing since last year — numbers now being questioned by advocates for buyers. The association also released a...

Interest Rates are Rising

I had the privilege of being interviewed by the Vancouver Sun last week about the fact that interest rates are rising, and wanted to share some snippets of that article here with you. The post is about the current [and more to come] interest rate increase, and how...

Single Ladies Buying Homes

It’s becoming increasingly apparent that a greater number of women are now taking the reigns when it comes to home purchases. There’s a growing trend among single women – and, more precisely, professional single women – who are becoming independent homeowners. While...

Higher Mortgage Rates Are On the Horizon

As per the FinancialPost.com "It may be stressful to think about it but higher mortgage rates are on the horizon." "The questions for homeowners is whether they can handle a hike in interest rates. Bank of Montreal says consumers should stress test their mortgages a...

Negotiating Your Mortgage in Vancouver

Negotiating a Mortgage in Vancouver Independent mortgage consultants are more likely to give you better deals than your bank. As with property prices, shopping for mortgages is changing. New mortgage options and features are introduced on a daily basis. It is also...

A New Bank With a New Model — Canadian First

Re-posted from CanadianMortgageTrends.com. A New Bank With a New Model — Canadian First. Being a Canadian bank puts you in exclusive company. There are 5,991 commercial banks in the U.S., but just 25 schedule I banks in Canada. That number will soon become 26 because...

Introducing Dominion Lending Centres Visa Cards

Introducing Dominion Lending Centres Visa Cards I'm excited to let you know that Dominion Lending Centres has partnered with Visa and Desjardins to be able to offer our valuable clients Dominion Lending Centres Visa cards. I can now offer you a great credit card at...

Tips to Pay Off your Mortgage Faster

The following is a Guest Post by Comparasave. Tips to Pay Off your Mortgage Faster Mortgages are one of the main sources of debt in Canadian households, so it’s not surprising that most of us want to find a way to rid ourselves of this financial burden as soon as...

Home Owner Grant

Just a gentle reminder to all you homeowners....don't forget to apply for your HOME OWNER GRANT...don't assume that it applies itself. About The Home Owner Grant The purpose of the home owner grant is to help reduce the amount of residential property tax British...

Not All New Rules Are Old Rules

Not All New Rules Are Old Rules In the last four and a half years, federal regulators have instituted more than two dozen mortgage-related policies and regulations. It’s a well-intended attempt to engineer a market correction (the proverbial “soft landing”) and add...

Taking Longer to Pay off a Mortgage

As reported by CanadianMortgageTrends.com: "Several polls have suggested that it’s taking longer to pay off a mortgage. The latest such survey came out on Friday." CIBC Poll - Canadians don't expect to be mortgage free until age 57 Non-mortgage debt a key obstacle to...

Signs of Life in the Spring Market

There are signs of life in the spring market. Finally! After many months (years?) of disappointment and fear, things appear to be looking more positive for the real estate market in the Greater Vancouver area. MCAP reports: "there was a bit of positive news on the...

Full Frill or No Frill

You're FINALLY ready to buy a new home! You can hardly wait, but you need to get the perfect mortgage first. When acquiring a new mortgage make sure to always ask this question, among others of course: full frill or no frill? What exactly does full frill or...

March is Anti Fraud Month

March is Anti Fraud Month: Avoid being a mortgage-fraud victim! I woke up to an article online today that needs sharing! March is Anti Fraud month. You can read the official Canadian website regarding this subject by clicking here. Fraud is a very real present day...

Rid Yourself of High Interest Debt

It's never too late to rid yourself of high interest debt! Plan to minimize spending that's racking up interest on credit cards/unsecured loans. Many people suffer from post New Year's hangovers as their holiday spending account statements begin to arrive in the...

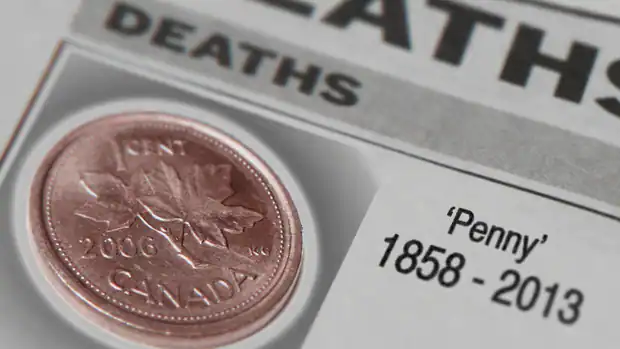

RRSP and Your Down Payment

Saving for your down-payment is not always an easy task. Now that the Canadian Government has decided to stop making the penny it will be harder than ever to "pinch pennies"! There are measures that you can take however, to make things a little bit easier on you and...

Love and Mortgage: Make a Commitment Without Regrets

Home loans last longer than most marriages (and may be more expensive), so you should take as much care in choosing a mortgage as you do a mate. Just as it's generally not wise to rush to the altar after one or two dates, it also doesn't make sense to commit to 25...