As reported from BCREA: Muted Impact Expected From Cancelled Investor Immigrant Program The British Columbia Real Estate Association (BCREA) reports that a total of 4,244 residential sales were recorded by the Multiple Listing Service® (MLS®) in January, up 24.5 per...

Geoff

Did You Know

I've been doing a series on my Facebook page recently called... Did You Know.... "that you might want to try increasing your monthly mortgage payment. It WILL save you money.... a lot! Let's say your mortgage is $1328.44/month. If you round up to $1400.00/month...

Have Some Sweets On Us For The Kids of Kenya

Have Some Sweets On Us For The Kids of Kenya Imani Orphan Care is a Canadian non-profit organization that supports children and families in need in Kenya. These precious children were abandoned by their families, orphaned or rescued from an unhealthy situation. We...

Borrowers Hit Social Media Hurdles

I read an interesting article today out of the United States on how borrowers are needing to jump through social media hurdles from lenders. It reads; "Regulators Have Concerns About Lenders' Use of Facebook, Other Sites". More and more lending companies are...

Fraser Valley’s Housing Market Quiet Yet Stable in 2013

Neither predictions of a huge crash or notable recovery came to pass in 2013 as Fraser Valley’s real estate market stayed slow and steady, similar to 2012’s market. Fraser Valley’s total sales volume last year was 13,663 a decrease of 1.5 per cent compared to 13,878...

Don’t Let Over-Spending Ruin Your Holiday This Year

I'd like to share a very useful post with you today on over-spending during the holidays. Even if you have the best intentions of spending limits during the holidays one can be so easily persuaded to spend more than budgeted for. Whether it is a killer Cyber Monday...

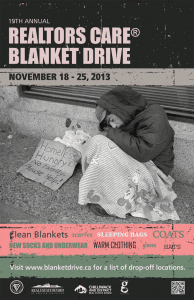

Blanket Drive offers first line of defence for thousands in need

19th annual REALTORS Care® Blanket Drive collection will run Nov. 18-25 VANCOUVER –Chances are high that many of the 1,600 homeless people currently living in Vancouver; 400 in Surrey, and 200 in Abbotsford have received a blanket, coat or multiple changes of clothing...

BC Home Sales Post Strongest October in Four Years

The British Columbia Real Estate Association (BCREA) reports that a total of 6,673 residential sales were recorded by the Multiple Listing Service® (MLS®) in BC during October, up 26.5 per cent from October 2012. Total sales dollar volume was 34.5 per cent higher than...

Balanced Conditions Continue in the Greater Vancouver Housing Market

From the REBGV: Balanced conditions continue in the Greater Vancouver Housing Market Home buyer and seller activity continues to mirror historical averages in the Greater Vancouver housing market. These trends have helped keep the region in a balanced state for the...

BCREA Housing Market Update

BCREA Housing Market Update BC Real Estate Association (BCREA) Chief Economist Cameron Muir discusses the September 2013 statistics. The British Columbia Real Estate Association (BCREA) reports that a total of 6,498 residential sales were recorded by the Multiple...

Continuously Developing New Ways to Serve You

I read an interesting article this morning that prompted today's blog post. Essentially, "mortgage brokers need to continuously be researching and developing new ways of doing business" so as to not get "Netflixed" out of business. If you know me at all, or have done...

Mortgages Rates are rising but you don’t need to be Alarmed

Yes, rates are rising. However, STOP! Don't to be alarmed! Consider this, rates just 5 years ago were above 5% . We are STILL below that! We need to stop raising the red flags of despair and the concerns about these high rates. In reality these are still great rates....