You're FINALLY ready to buy a new home! You can hardly wait, but you need to get the perfect mortgage first. When acquiring a new mortgage make sure to always ask this question, among others of course: full frill or no frill? What exactly does full frill or...

Geoff

March is Anti Fraud Month

March is Anti Fraud Month: Avoid being a mortgage-fraud victim! I woke up to an article online today that needs sharing! March is Anti Fraud month. You can read the official Canadian website regarding this subject by clicking here. Fraud is a very real present day...

Rid Yourself of High Interest Debt

It's never too late to rid yourself of high interest debt! Plan to minimize spending that's racking up interest on credit cards/unsecured loans. Many people suffer from post New Year's hangovers as their holiday spending account statements begin to arrive in the...

RRSP and Your Down Payment

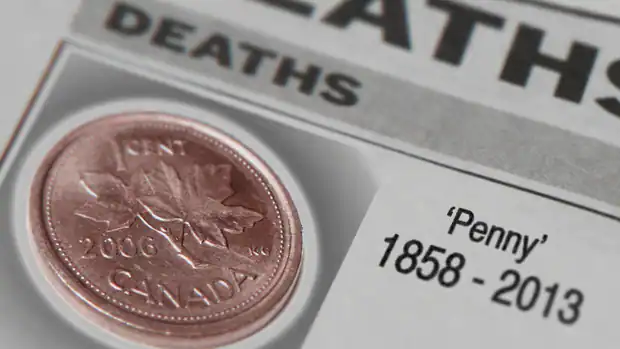

Saving for your down-payment is not always an easy task. Now that the Canadian Government has decided to stop making the penny it will be harder than ever to "pinch pennies"! There are measures that you can take however, to make things a little bit easier on you and...

Love and Mortgage: Make a Commitment Without Regrets

Home loans last longer than most marriages (and may be more expensive), so you should take as much care in choosing a mortgage as you do a mate. Just as it's generally not wise to rush to the altar after one or two dates, it also doesn't make sense to commit to 25...

Do The Math: Housing Costs Add Up

Are you trying to fully comprehend the REAL costs of Home Ownership? Most people feel surprised or even confused by some of the extra costs involved, so we are trying to make things completely clear for you as a consumer so that you can search for affordable housing...

10 Questions Mortgage Borrowers Should Ask (But Often Don’t)

Here are 10 questions mortgage borrowers should ask, but often don't: 1. If I have mortgage default insurance do I also need mortgage life insurance? • Yes. Mortgage life insurance is a life insurance policy on a homeowner, which will allow your family or dependents...

10 Questions to Ask Your Home Inspector

The purchase of a home is likely the largest financial expenditure you’ll ever make. And getting your home inspected is an essential step in the home-buying process. No one wants to buy a money pit – and once you have signed on the dotted line, there is no turning...

Tips for Paying Off Your Mortgage Faster

Mortgages in Canada are generally amortized between 25 and 35 year terms. While this seems a long time, it does not have to take anyone that long to pay off their mortgage if they choose to do so in a shorter period of time. Therefore, today's post contains ideas on...

10 Great Reasons to Use a Mortgage Broker

I am frequently asked why a mortgage broker and not a financial institution. Here's a list I found that answers this completely that I wanted to share with you: 10 Great Reasons to Use a Mortgage Broker Get independent advice on your financial options. As independent...

The Hidden Costs of Home Ownership

For as long as I've been doing this, I've rarely come across someone who has NOT been somewhat overwhelmed with the extra hidden costs that are associated with buying that new home and moving. Just to give you an idea, here is a list of the types of extra costs that...

More Mortgage Rules Changes

Just like you, I'm always learning and growing and listening to those that have gone before me. I've met some amazing mortgage broker colleagues along the way, and always love to share their knowledge and wisdom to my own readers and followers. Today is no exception....