Increasing Your Purchase Power Most individuals that we connect with to discuss a Mortgage Pre-Approval also want to know how we can go about Increasing Your Purchase Power. More often than not, those individuals could afford to make mortgage payments. Usually,...

Geoff

Personalities of Your Mortgage

Personalities of Your Mortgage Personalities of Your Mortgage Asking the right questions and understanding the Personalities of Your Mortgage is an important part of the mortgage process as it will allow you to understand which mortgage product is right for you! An...

Private Lending Mortgages

a href="https://geoffleemortgage.com/wp-content/uploads/2021/12/Private-Lending-Blog-Image.jpg"> Private Lending Mortgages Private Lending Mortgages or Alternate financing, although usually a more expensive option, can facilitate all kinds of client scenarios. If...

Geoff Lee Recognized by Canadian Mortgage Professional Magazine

GLM Mortgage Group | Dominion Lending Centres is thrilled to announce that Geoff Lee has been selected by Canadian Mortgage Professional as one of Canada’s Top 75 Mortgage Brokers. In addition to being a Top 75 Mortgage Broker in Canada GLM Mortgage Group | Dominion...

When it comes to getting pre-approved for a mortgage and “Locking” in a rate, we have a clear process in place to help you do so.

How it works: We start with a pre-approval where a mortgage application is done, and documentation is requested to confirm details within the application to best prepare for an accepted offer. Once you complete the pre-approval process, we can then determine your max...

Pre-Approval: Does it Hurt My Credit Score?

One of the most common questions we are asked when going through the pre-approval process: Will this hurt my credit score? It’s a fair question. The reason many people ask if a pre-approval will hurt their credit score is due to the fact that typically a hard...

Fast Five | October Edition

Hello folks! Today we are delivering you our Fast Five for this month--the top 5 things happening in the mortgage world right now that you need to know about. Let's dive in, shall we? 1. Record Setting Month in Real Estate Both August and September were record...

Breaking a Mortgage in 2020

Did you know that 6 out of 10 consumers break their mortgage within 3 years into a 5-year term? That means that 6/10 of borrowers will break a 5-year term mortgage well before it’s due…but do you also know what the implications are of this? With the increase of...

Stress Test Rate Drop Information | All in One Place!

Let's talk about the state of the rate! In order to find out how the current Stress test rate impacts you, first you need to determine if you're an insured or uninsured borrower. Option one: Do you have less than 20% down? Securing an insured...

Fast Five | August Edition

Can you believe we are already into August? This month brings about a whole new list of resources and links for us to share with you and our focus shifts to what is coming up for Canadian's as certain COVID-19 programs close or are folded into current programs. Read...

How does a Mortgage Agent get Paid?

For many, buying a home is a very exciting time! You are beginning to plan out the next chapter (or the next big step) in your future! It can also be a time though where your time is in short supply and perhaps you don't have time to go from one lender to the next...

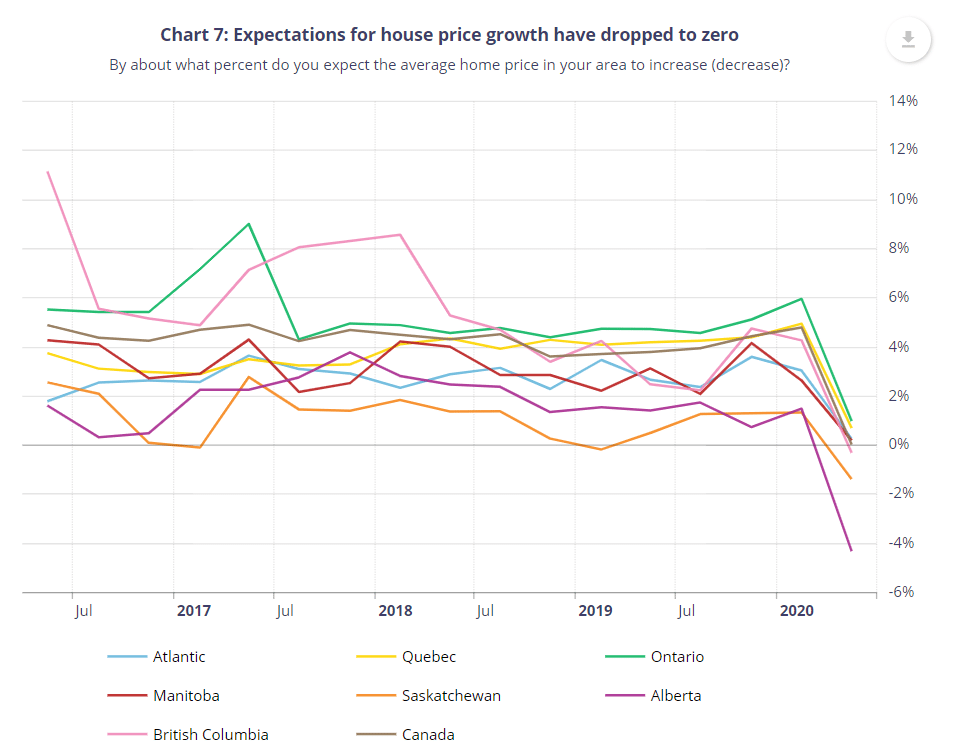

Canadian Business Sentiment Is Negative

This article was originally featured on Dominion Lending Centres Blog, written by Dr. Sherry Cooper. but we wanted to share this insightful information with you. It is our deepest desire to keep our clients well-versed in not only mortgage news, but also economic...