by Geoff | Apr 10, 2022 | First Time Home Buyers, Getting a Mortgage, Homeowners Grant

The Benefits of Being a First Time Home Buyer Being a First Time Home Buyer is an amazing accomplishment that comes with many responsibilities and incentives. Discussed in our previous blog The First Time Home Buyer’s Incentive Plan otherwise referred to as the...

by Geoff | Mar 27, 2022 | CMHC, Credit Score, DLC, First Time Home Buyers, Getting a Mortgage, homeowners, Homeowners Grant, House Hunting, Mortgage Broker, Mortgage Insurance, mortgage trends, Rates, Real Estate, Real Estate Investing, Refinancing, Reverse Mortgages

Rent to Own Mortgage A Rent to Own contract could be the answer for someone who is renting but is also having a hard time getting their down payment together. Rent to Own contracts usually are between 1 and 5 years long and can give the client the time they...

by Geoff | Mar 20, 2022 | Bank of Canada, Finances, First Time Home Buyers, Rates

Banks VS Credit Unions Finding somewhere to trust with your life savings and all personal information can be a big decision. Two of the most common types of facilities that are around to help are either Banks or Credit Unions. Banks VS Credit Unions… What is...

by Geoff | Mar 14, 2022 | Bank of Canada, CMHC, Credit Score, DLC, First Time Home Buyers, Getting a Mortgage, House Hunting, Mortgage Broker, Mortgage Insurance, mortgage trends, Rates, Real Estate, Reverse Mortgages

Mortgaging a Property via Assignment Mortgaging a property via assignment is a contract provision included in some real estate transactions that allow the buyer to resell or transfer a property to another buyer before the deal’s closing date. As one of...

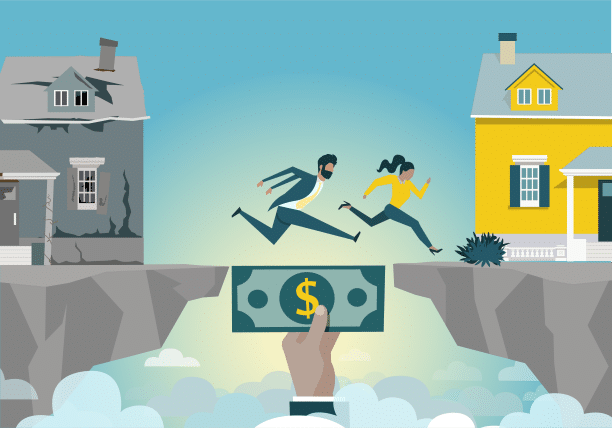

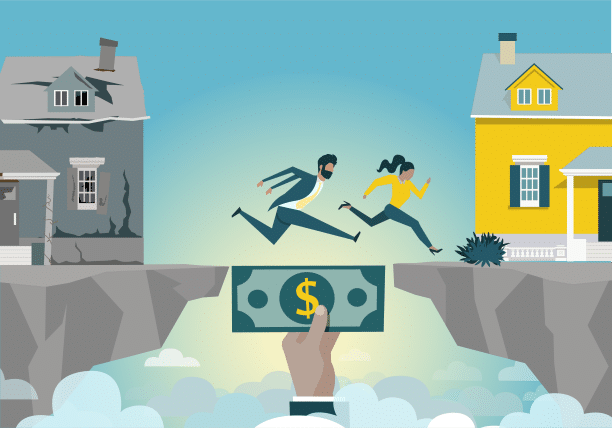

by Geoff | Mar 6, 2022 | Bank of Canada, CMHC, DLC, First Time Home Buyers, Getting a Mortgage, homeowners, Homeowners Grant, House Hunting, mortgage trends, Rates, Real Estate, Refinancing, Reverse Mortgages

Bridge Financing Bridge Financing, also commonly referred to as a “Bridge Loan”, is a way to help literally bridge the gap between closing on your current house and your new place. This product allows you to carry the mortgage on two properties for a specified...

by Geoff | Feb 27, 2022 | Bank of Canada, CMHC, DLC, First Time Home Buyers, Getting a Mortgage, Mortgage Broker, Mortgage Insurance, Rates, Refinancing, Reverse Mortgages, Strategy, Uncategorized

Our Discovery Call A Discovery Call is our first touchpoint with your client. We make a quick 5–10-minute phone call to simply connect with the client and gather some basic information regarding a mortgage pre-approval. After we ask the client all necessary...

Recent Comments