by Geoff | Feb 20, 2022 | CMHC, DLC, First Time Home Buyers, Getting a Mortgage, Homeowners Grant, Mortgage Broker, Mortgage Insurance, Rates, Refinancing

First Time Home Buyer’s Program The First Time Home Buyer’s Program otherwise referred to as the FTHBI is a Canadian Government program, which contributes up to 10% to the down payment for First Time Home Buyers. This is an effort to support borrowers in their...

by Geoff | Feb 14, 2022 | Bank of Canada, CMHC, Credit Score, DLC, Economy, First Time Home Buyers, Getting a Mortgage, House Hunting, Mortgage Broker, Mortgage Insurance, Rates, Real Estate Investing, Refinancing

How Mortgage Rates Work The topic of how Mortgage Rates work is a long, complicated series of moving puzzle pieces that work together perfectly. Today we are going to break it down as best we can. During the process of taking out your first mortgage, you will learn...

by Geoff | Feb 8, 2022 | Bank of Canada, CMHC, DLC, First Time Home Buyers, Getting a Mortgage, Mortgage Broker, Mortgage Insurance, mortgage trends, Rates

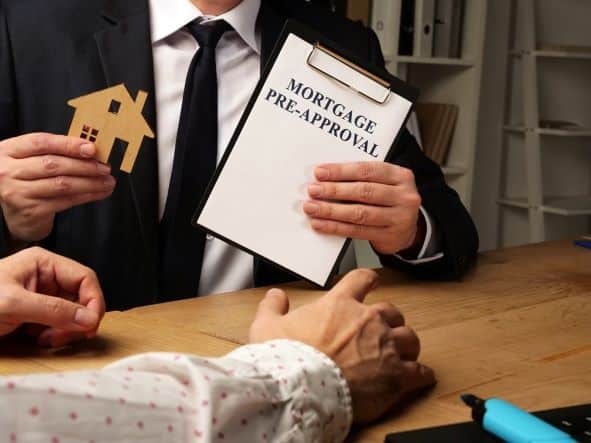

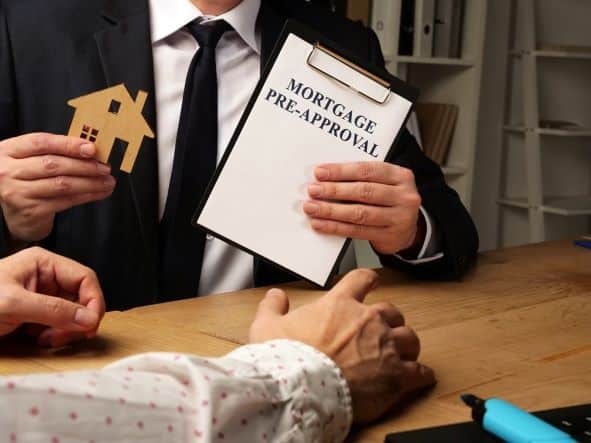

Pre-Approval VS Rate Hold Pre-Approval VS Rate Hold… what are the differences? What are the benefits? Not even one Mortgage or Pre-Approval Process is the exact same as someone else’s. The Mortgage and Pre-Approval process are complex mazes of tiny puzzle pieces...

by Geoff | Dec 23, 2021 | CMHC, DLC, Finances, First Time Home Buyers, Getting a Mortgage, homeowners, Homeowners Grant, House Hunting, Mortgage Broker, Refinancing, Reverse Mortgages

Increasing Your Purchase Power Most individuals that we connect with to discuss a Mortgage Pre-Approval also want to know how we can go about Increasing Your Purchase Power. More often than not, those individuals could afford to make mortgage payments. Usually,...

by Aidan | Sep 29, 2021 | First Time Home Buyers

Many homeowners will start off renting and will eventually enter the real estate market with a purchase of a home – it is an overwhelming, exciting, and rewarding journey. And once we own a home, we will then go through the transfer/switch/refinance process when the...

by Geoff | Sep 4, 2020 | Bank of Canada, First Time Home Buyers, Getting a Mortgage

Let’s talk about the state of the rate! In order to find out how the current Stress test rate impacts you, first you need to determine if you’re an insured or uninsured borrower. Option one: Do you have less than 20% down? Securing an...

Recent Comments